Citibank. Citi Renewed

Challenge: How do you make the world’s biggest bank, the world’s biggest un-bank? How do you prove a totally new way of thinking and acting to an angry public, and skeptical politicians - in the wake of the chaos and mistrust generated by the global financial crisis?

Solution: City Renewed. A strategic rebranding of the world’s largest financial organization that I was joint lead on at Landor. .

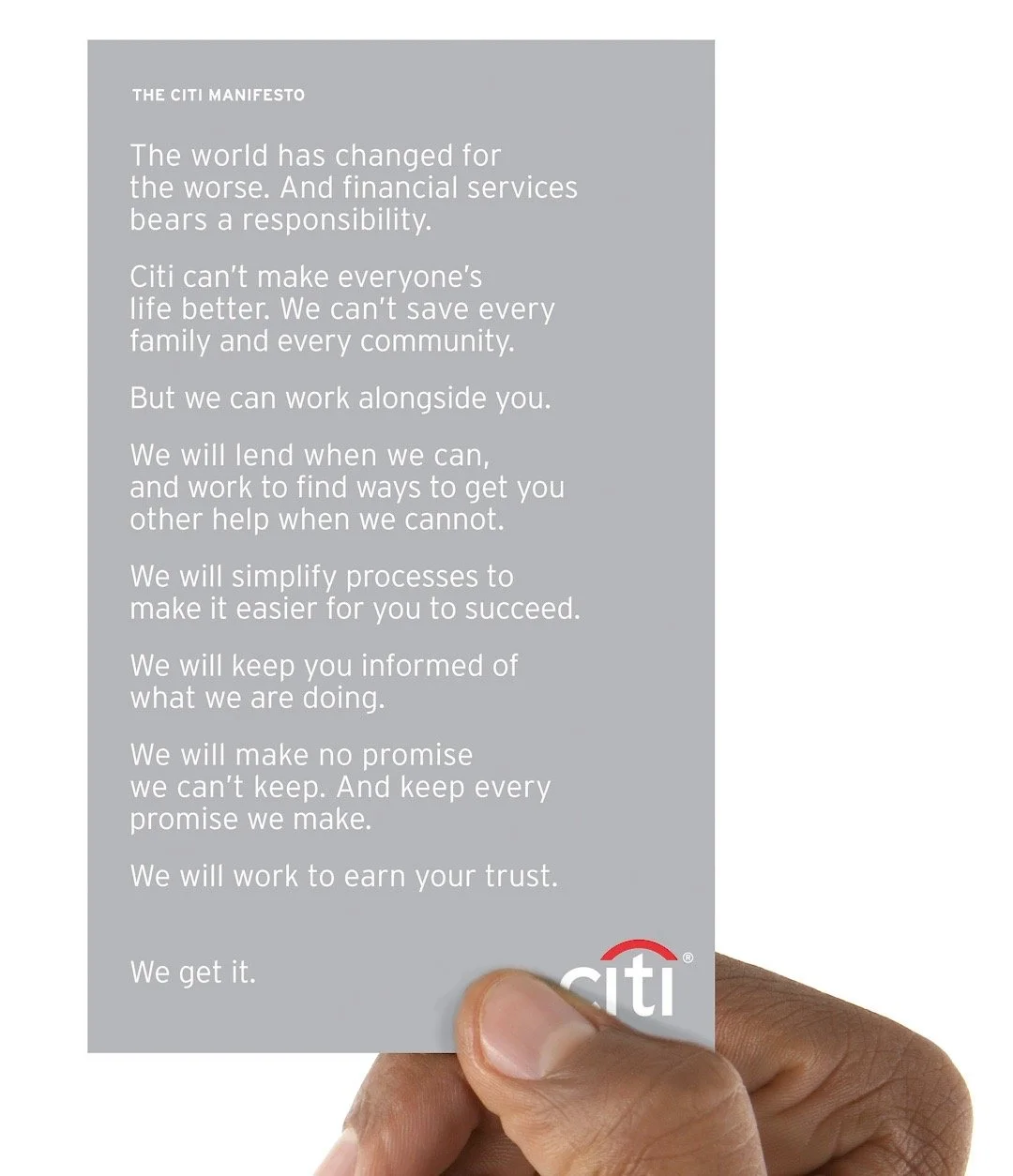

IT STARTED WITH A MANIFESTO

Previously, Citi had seemed an “all-powerful” presence. With a Brand Promise of “Dreams to Reality”. But that seemed hollow when businesses were closing and people were losing their homes. The Citi Manifesto formed the basis of a new way forward. One marked by a new humility, realism, and willingness to engage side-by-side with people and communities. The Citi Manifesto would sit prominently in advertising and every Citibank branch. It would also form the basis of a range of new Brand engagements.

The world had changed. Citi needed to change too. Because, when the chips are down, real corporate strength isn't about beating your chest. It's about keeping your promises.

From this…

We proposed a range of new Brand engagements to prove our new intent:

PRACTICAL HELP FOR LOCAL COMMUNITIES

The manifesto promised a new focus on working with local people. So we looked at ways to use underutilized space in local branches, and the knowledge of wealth consultants, in new and practical ways. Repurposing physical resources to offer regular “lunch and learn” sessions in this underused space. To demonstrate Citi’s commitment to the local community without significantly increasing costs.

NEW LUNCH AND LEARN PROGRAM

In the past, Citi paid to put its name on giant sports arenas. Now it would use its own real estate to benefit struggling communities in practical ways.

2. INNOVATIVE WAYS TO KICKSTART NEW BUSINESSES

Malls emptied as the crisis grew. The Change Center program aimed to reverse the trend.

Citi would go to failing malls and Main Streets - and lease empty stores to turn them into Citi Change Centers. Where we’d hold seminars on writing business plans, working with vendors, etc. - in those unused spaces. The aim was to offer “fast-start incubators” across America to get a new generation of businesses off the ground.

CITI CHANGE CENTERS

Malls were emptying across America as recession bit. So let's fix that. By creating pop-up business startup centers in empty mall spaces across America. The spaces would then be left to successful new businesses we’d helped create. These would be labeled as a product of the program. So people could see the change happening - and Citi’s part in it.

3. Radical New Product Development

Citi delivered Microfinance products in developing nations to boost regional growth and help address poverty. We proposed Citi now brought that expertise to local communities in America. Taking inspiration from programs like Farm Aid, we imagined a product where customers could invest in local micro-financing initiatives in agriculture, housing, education, or community education and health care. Taking its symbol as the Delta “Δ”, the scientific symbol for change - we called it the Citi Triangle Program.

CITI TRIANGLE PROGRAM

Leveraging Citi's existing expertise in micro-finance in developing nations to focus on the needs of local communities.

4. NEW PROGRAMS TO IDENTIFY AND PROPaGATE THOUGHT LEADERSHIP

Within each industry one or two companies are acknowledged and respected as the “thought leaders”. Citi was one of those companies. But its reputation - and self-belief - had been damaged. So we needed to actively seek the next generation whose ideas would take Citi forward.

The Citi Arc Awards was a new program to do that. The Award was shaped like the Arc in the Citibank logo. Originally, designed to signify shelter - it would now represent the bridge from the present to the Citi of the future.

CITI ARC AWARDS

This web-based awards scheme would share the best thinking from every region and division – in a way every region could access. Identifying the next generation of thought-leaders across Citi's global network. Promoting Citi’s industry leadership. And the best new ideas and people more rapidly.

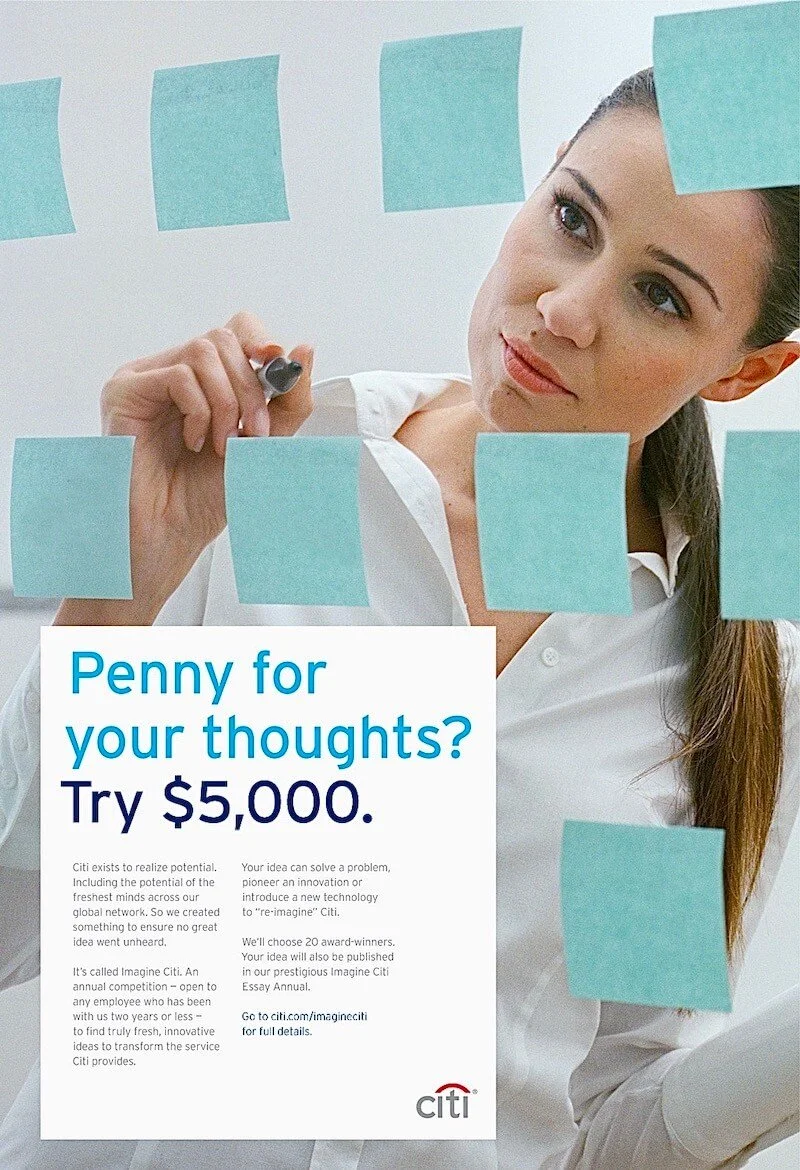

5. New Ways to integrate outsider thinking

Sometimes outsiders see things that insiders don’t. Offering new perspectives and solutions that could prove invaluable in the new environment. But typically, newcomers aren’t listened to until they’ve worked their way up. So how do we square the circle?

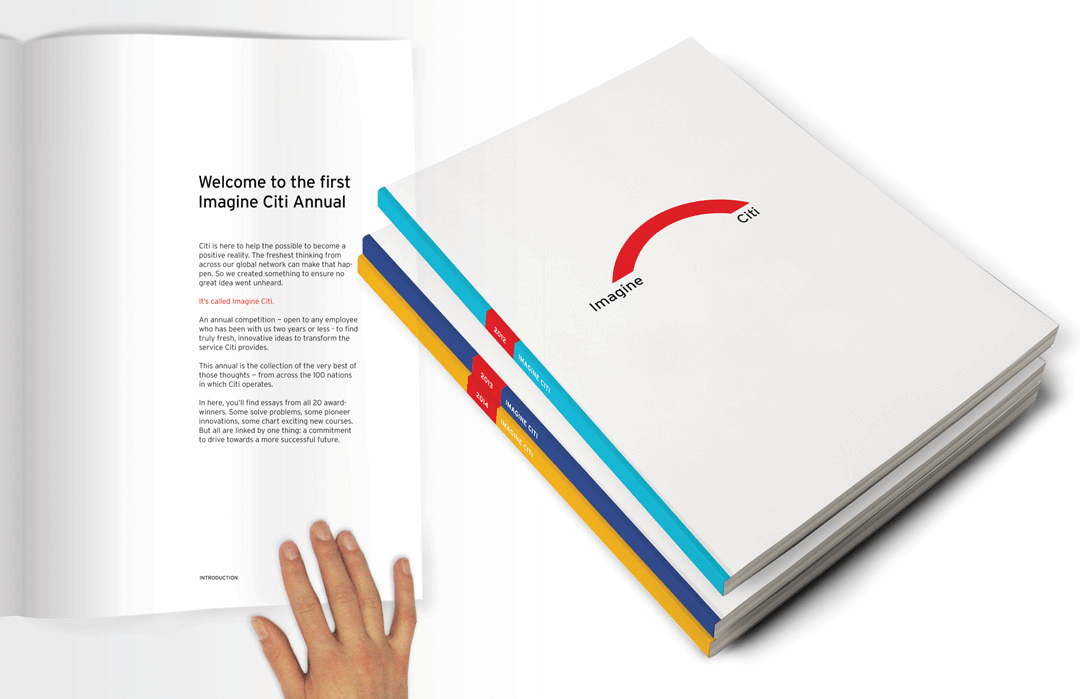

Imagine Citi was an annual competition designed to do that. It was designed for new Citi employees – as a way to tap into their unique perspectives. Winning essays would be published in an annual collection – bringing new thinking to the table that might otherwise take years to break through.

IMAGINE CITI

Every company has a certain way of thinking. This can blind people to solutions that don’t fit with their organization’s existing way of doing things. “Imagine Citi” was designed to encourage, incentivize and leverage the best outsider thinking of new hires.

6. NEW DIGITAL TOOLS TO BUILD TRANSPARENCY AND TRUST

How could families and communities be sure that Citi was doing the right thing with the funds they were getting from the US government’s Troubled Asset Relief Program (TARP) - at a time when trust was in short supply?

We proposed a series of digital products to prove Citi’s new sense of responsibility and community partnership. Through real-time local spending updates on the web, in retail bank windows - and on customer’s phones.

WHERE CITI'S HELPING NOW

App-based, online and in-store digital products. Designed to raise awareness of precisely where Citi was spending government TARP loans - in real time. Users could drill in to see where help was arriving in your community to the areas – and on the things – that matter to you. Building community confidence and reducing mistrust.

7. Other Proposals

A tone tailored to each customer

CITI TALK. What if we could individually tailor how we talked to each customer across all channels – based on the enormous amount Citi already knew about each customer? So everything from Call Centers to ATMs to the bank's online presence became more and more "naturalized" to each customer.

new mechanisms to avoid “groupthink”

CITI DISRUPT.

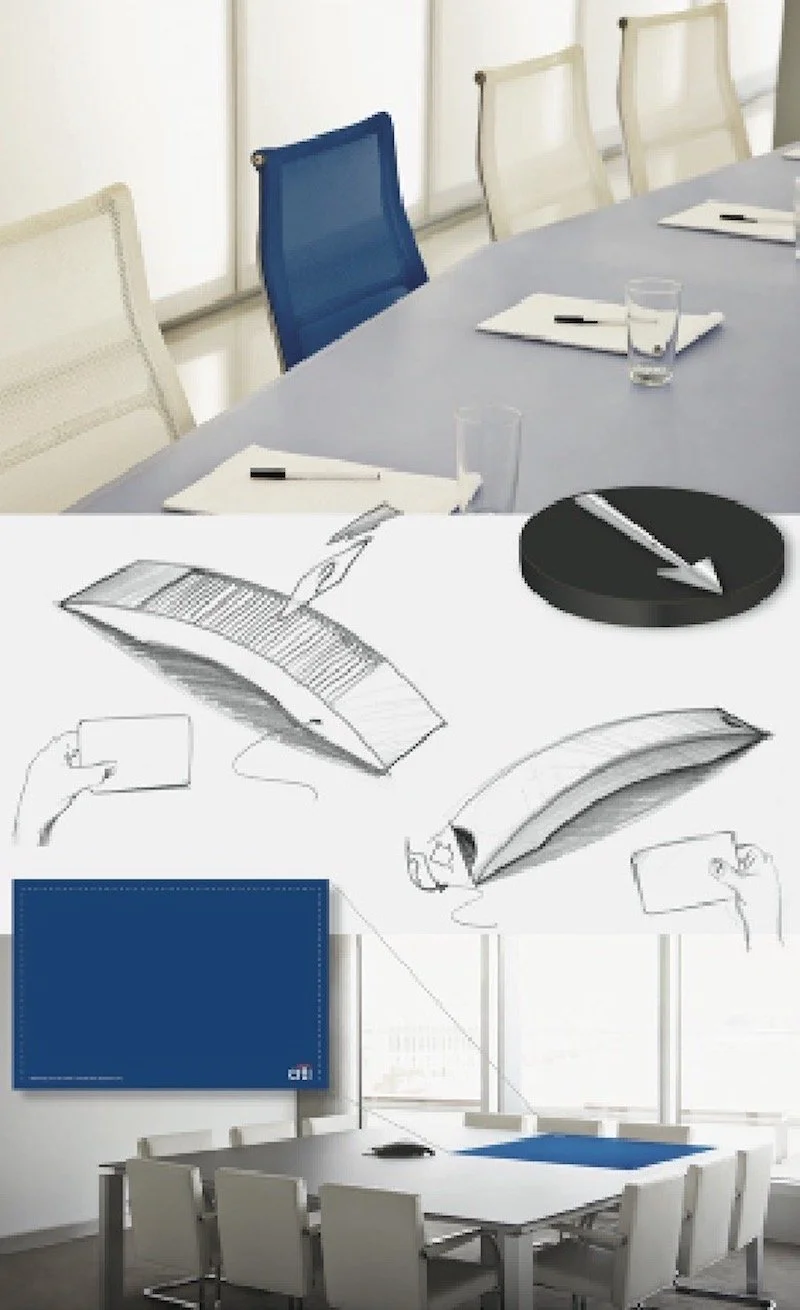

Many believed the financial crisis was caused by bad decisions in key meeting going unchallenged in the big banks. Due to hive thinking or fear of voicing dissent.. Citi Disrupt was a way of fighting this.

Ancient Athens’ radical democracy used randomizing machines to ensure a wide range of voices in every key decision. So we proposed Citi do the same:

Every major meeting would have a device filled with randomized tricky questions. To disrupt “great ideas” that weren’t well thought through.

These would be voiced by a designated Customer Advocate, randomly selected from meeting participants to say the unsayable.

They would sit in a specially designated - and differently colored - “customer advocate” chair. To reinforce the presence of the end customer in each meeting.

This would help get alternate perspectives into the key decisions - without those voicing them suffering “negative consequences”.

OUTCOMES

Citi Renewed was a large, multi-layered project of real size and scale. Made more complex - and more exciting - by the fact we were dealing with a political hot potato - at a time of major crisis.

Not every idea made it through to the real world. But many did. Including the launch of the global Citi Arc Awards program, while the core Citi Manifesto idea became the “Promises” campaign, seen here running across New York City.