Citibank.

Challenge: The Financial Crisis made most major banks very unpopular. They were criticised for arrogance - and for failing to stand behind people when they needed it most. Our client was Citibank. The world’s largest bank. And for a time, possibly the world’s most unpopular. So how do you restore trust at a moment of historic uncertainty?

Solution: City Renewed. A strategic rethinking of the world’s biggest financial organization - in the wake of the chaos and mistrust generated by the Financial Crisis.

Citi Renewed: A Response to the Financial Crisis

Citi’s Brand Platform promised “Dreams to Reality”. You only had to wish it, and Citi could make it happen. But the new environment had proved the limit of any bank’s power. So where do you go now?

Citi Renewed: A Response to the Financial Crisis

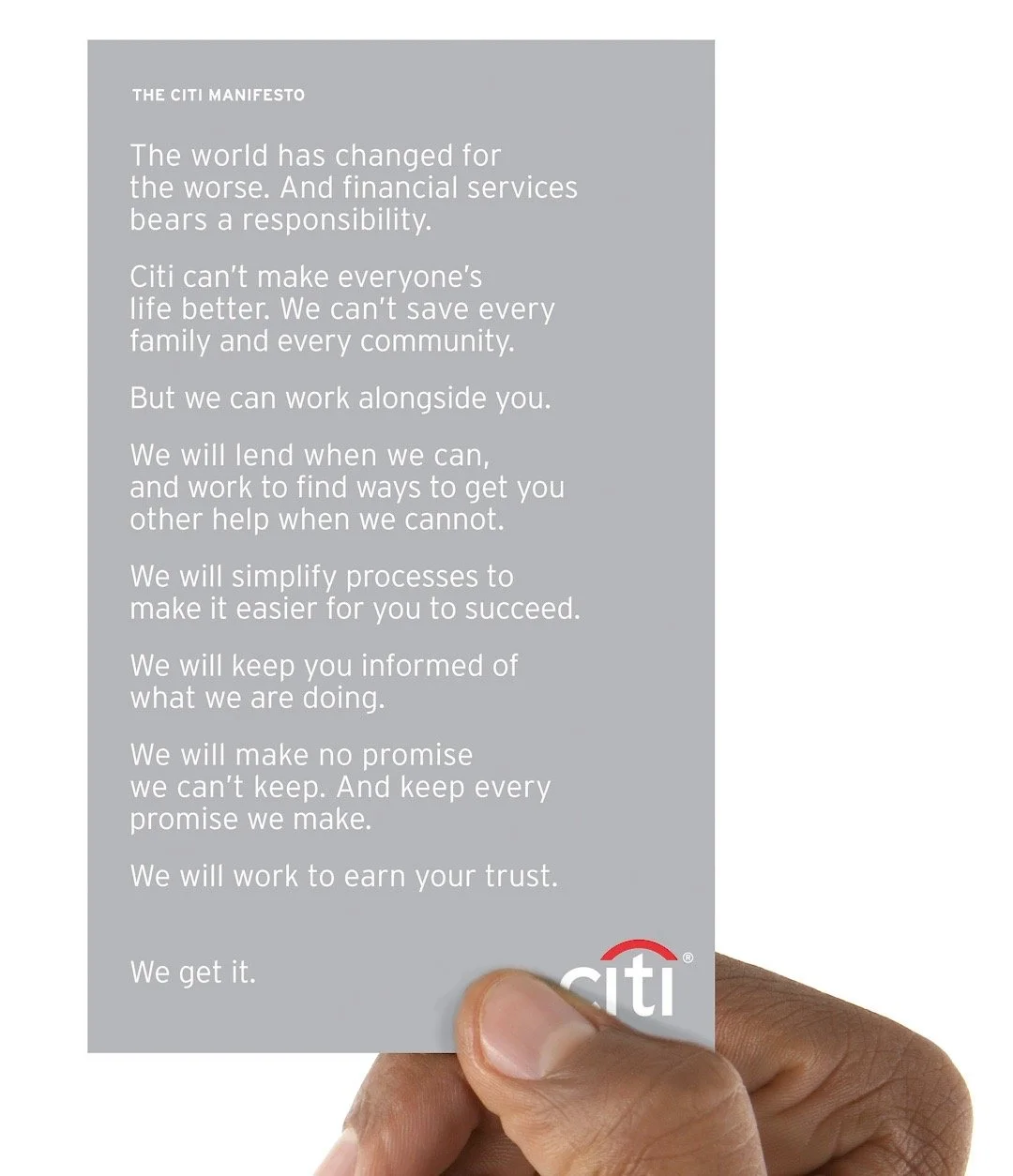

I start with a manifesto. Based on an idea in Neitszche. That true strength doesn’t come from status or bombast but from the simple power to keep your word. Citi had been humbled. But we’d learned. In future we’d make fewer, simpler promises. But keep every promise we’d make. The new Citi wasn’t above humanity, granting wishes. But working within communities, alongside people helping them rise in practical ways.

It was written to signal both internally and to the world that the effects of the financial crisis required company-wide change. And this cultural shift would be reflected in day-to-day business with certainty. The intent was for it to be printed in advertisements and handed out to every customer after every transaction.

Following the line in the manifesto about working with people, programs for retail bank clients and small businesses were proposed.

First we looked at the typical brick and mortar bank. When you walk into a typical bank, it is a pretty common sight to see empty desks and short lines. Wealth management consultants rotate through several branches and customers are banking online more frequently. So there’s a lot of real estate which is underused.

As mentioned above, Citi employs some pretty smart people. So why not tap into that resource and have the brightest offer regular “lunch and learn” sessions in this underused space? It would demonstrate Citi’s commitment to the local community without adding to capital expense.

And for the small-business owner, we took a cue from the New York City Police Department’s famous Broken Windows theory. Small acts of decay aren’t small, because they lead to bigger ones. And similarly small acts of renewal are significant too because they have the multiplier effect.

We go where retail is failing. And start to make a difference there. Identify an empty storefronts and arrange with the landlord to hold seminars on writing a business plan, working with vendors, etc -in those unused spaces.

And if an alumni took over that space, the business would be labeled as a product of the program. So people could see the change happening and see Citi’s part in it.

We called it the Citi Change Program.

Citi has done business in microfinance since 2005. Often seen as a contributor to economic growth in developing regions, as well as one method to address poverty, microfinance is also how Citi could signal their commitment to the community.

We imagined a product where banking consumers could invest in microfinancing initiatives in agriculture (à la Farm Aid), their local communities (à la Habitat for Humanity), or even their family’s education and health care (à la Flex Spending). Taking its symbol from the delta, mathematical and scientific symbol for change, we called it the Citi Triangle Program

Within each industry, there are usually a small group of companies which are considered to be “the Academy” – where careers are made, where industry standards are established, etc. Within financial services, Citi is such a company. I sometimes attend investment or wealth management events presented by other companies, and often speakers will mention Citi as a formative part of their career.

With that in mind, we took a cue from many other large companies and presented the concept of an internal award program to recognize employee innovation and excellence – as a way to develop and retain talent, set high benchmarks for all employees, and potentially as a way to promote Citi’s industry leadership.

The Citi logo has a red arc spanning over the last three letters. Originally designed for the merger of Citigroup and Travellers, the arc with the letter “t” comprised the Travellers umbrella. But years later, with the divestiture of Travellers assets, including the logo, the arc no longer could represent umbrella qualities like shelter. Instead, it represented the path / bridge / journey from dream to reality.

Thus, we named it the Citi Arc Award.

Designing the award itself was easy.

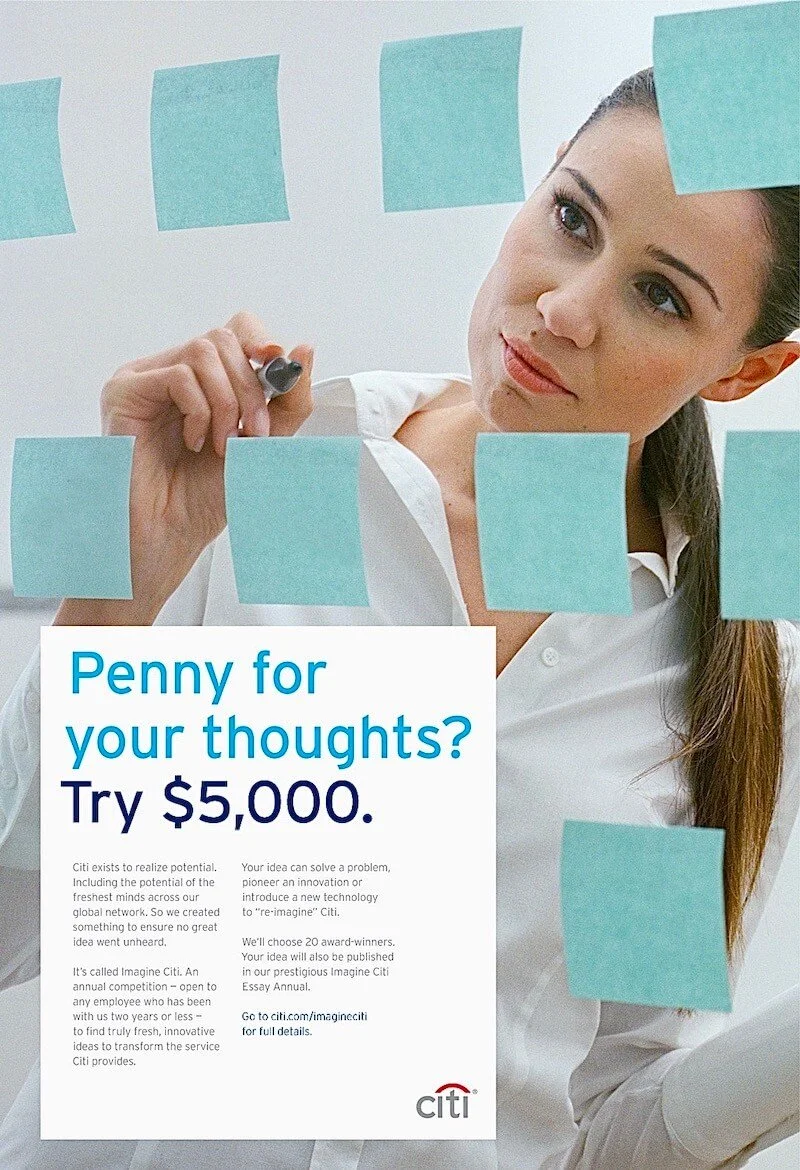

Another internal recognition program was called Imagine Citi. We envisioned an annual white paper competition for employees with less than two years at Citi – as a way to tap into their unique perspectives. The two-year time frame was chosen because that is the window when new employees best notice differences between where they were before and their current position.

Winning essays would be published in an annual collection – building a new generation of leaders and another aspect of Citi’s thought leadership.

Both the Arc Award and Imagine Citi programs were annual events. We also needed to consider employee engagement in the day-to-day. One simple thing could be a series of animations around the dualities of Citi/public, financial gain/social good, etc. They could appear on intranet pages and screens within the organization.

<video>

One continuing question throughout the financial crisis was what banks were doing with funds distributed through the US Government’s Troubled Asset Relief Program (TARP). So we proposed displaying the new sense of responsibility and community partnership, as defined in the manifesto, in real-time updates, on the web and in retail bank windows. Citi was in the beginning stages of installing such displays in Asia, so the institutional capability was already in place.

By the way, in the first quarter of 2009, when this information was collected, those numbers were accurate.

Projects like this come about infrequently. They are more about building the client relationship than answering to one’s P&L line. And it was only through the foresightedness of the Landor San Francisco office and our clients were we able to invest the time and resources.

Not everything we presented was executed as we envisioned. But from this beginning, we did develop a global marketing award program. And a few months later, Citi’s advertising parters at Publicis created a “promises” campaign which appeared only in New York City – home to most of the broadcast and print media covering the financial crisis.

Agency: Landor

Creative Direction, design: Mark Kingsley. Strategy, copy: Mike Kerr. Strategy: Thom Wyatt. Design: Carolyn Ashburn, JJ Ha, Henry Lannan. Design, animation: Ken Frederick. Photography: Michael Friel. Planning: Lynn Ritts, Julia Capeloto